| 🏛️ Based in | Limassol, Cyprus |

|---|---|

| ⚖️ Regulation | FSCA |

| 💰 Minimum Deposit | $250 (100000 Naira) |

| 💳 Deposit Options | VISA, MasterCard, Bank Wire, Neteller, Skrill. |

| 💳 Withdrawal Options | VISA, MasterCard, Bank Wire, Neteller, Skrill. |

| 📌Open an account | Start Trading with TrioMarkets |

Contents

- 1 Our Opinion About TrioMarkets

- 2 Key Benefits

- 3 TrioMarkets Regulation and Safety

- 4 Client Fund Safety

- 5 TrioMarkets: Legit or Scam?

- 6 TrioMarkets Trading Assets

- 7 TrioMarkets Accounts

- 8 Basic Account

- 9 Standard Account

- 10 Advanced Account

- 11 Premium Account

- 12 Trading Tools

- 13 Leverage, Spreads and Commissions

- 14 Deposits and Withdrawals

- 15 Account Registration

- 16 Bonuses and Promotions

- 17 Trading Platforms

- 18 Education and Research

- 19 Customer Support

- 20 Our Verdict on TrioMarkets for Nigerian Traders

- 21 TrioMarkets Forex Broker Review – FAQ

- 22 TrioMarkets Forex Broker Review – Similar Brokers

Our Opinion About TrioMarkets

TrioMarkets is a reputable forex and CFD broker serving traders globally since 2014. Based in Cyprus, this broker is well-regulated and offers competitive trading conditions on the popular MetaTrader 4 platform. Nigerian traders considering TrioMarkets will appreciate its wide range of tradable instruments, multiple account types to suit different trading styles and budgets, helpful trading tools, and quality educational resources.

While TrioMarkets has higher minimum deposits than some brokers, its tight spreads, reliable trade execution, and strong regulatory oversight help make it an appealing choice for many traders in Nigeria looking for a trusted broker partner. The broker’s excellent customer support and transparency further enhance its reputation.

Key Benefits

TrioMarkets Regulation and Safety

One of TrioMarkets’ key strengths is its solid regulatory framework. The broker’s parent company, Benor Capital Ltd, is authorized and regulated by Mauritius’s Financial Services Commission (FSC) under license number C118023678.

The broker’s other operating entity, EDR Financial Ltd, which is registered as a Cyprus Investment Firm (CIF) with license number 268/15 from the Cyprus Securities and Exchange Commission (CySEC), provides an additional layer of regulatory oversight. As a CySEC-regulated broker, TrioMarkets must comply with strict European regulatory requirements like client fund segregation and participation in investor compensation schemes.

TrioMarkets is also registered with financial authorities in several other jurisdictions it serves, including BaFin in Germany, FCA in the UK, CONSOB in Italy, and others, demonstrating its commitment to regulatory compliance. While not overseen directly by Nigerian authorities, these international licenses help ensure high security and fair trading practices for TrioMarkets’ global client base, including Nigerian traders.

Client Fund Safety

TrioMarkets has segregated accounts. This means that your money is held separately from their company funds, in top-tier banks, and that your money is safe even if TrioMarkets goes bankrupt. This is important because it also means that TrioMarkets is not able to use your money for operational purposes or to pay off any debts or liabilities.

TrioMarkets also offers negative balance protection, on request, and on a case by case basis. This is also important because it means that TrioMarkets is not able to let your account balance fall below zero. In terms of other client fund protection measures, TrioMarkets also has other security measures in place, such as SSL encryption and two-step authentication processes.

TrioMarkets: Legit or Scam?

Based on its long operational history, credible regulation, and positive overall reputation, we consider TrioMarkets a legitimate broker, not a scam. The company is transparent about its ownership, regulatory status, and trading conditions. It keeps client funds segregated and offers negative balance protection to retail clients.

Of course, it’s important to remember that trading forex and CFDs is risky, and even with a legit broker, you can lose money if markets move against you. However, Nigerian traders can feel confident that TrioMarkets is properly regulated and committed to fair, responsible practices regarding broker reliability and security. The broker has generally positive client reviews and has not been involved in major regulatory scandals.

TrioMarkets Trading Assets

TrioMarkets provides access to a good selection of trade instruments, focusing on forex currency pairs. Highlights of the broker’s 140+ tradable products include:

- 60+ forex pairs across majors, minors, and exotics

- Spot metals like gold and silver

- Energy CFDs, including oil and gas

- Stock index CFDs on major global indices

- Popular share CFDs

- Cryptocurrency CFDs, including Bitcoin

This wide asset choice allows Nigerian traders to diversify across markets and implement various strategies. TrioMarkets’ spreads are quite competitive, especially for forex trading, helping keep costs down.

TrioMarkets Accounts

To accommodate traders with different amounts of capital and trading styles, TrioMarkets offers multiple account types.

| Type | Spreads | Min. Deposit | Max. Leverage | Commission |

|---|---|---|---|---|

| Basic | From 2.4 pips | $100 | 1:500 | $0 |

| Standard | From 1.4 pips | $5,000 | 1:500 | $0 |

| Premium | From 1.1 pips | $25,000 | 1:500 | $0 |

| VIP | From 0.0 pips | $50,000 | 1:500 | $4 per lot |

Basic Account

This is their best account option for new traders in Nigeria. It comes with an average spread of 2.4 pips and there are no commissions. It also comes with high leverage of up to 1:500. The minimum deposit for this account is $100 and the base currency is USD. It is worth noting that the Basic Account is only available on MT4.

Standard Account

This is a good account option for intermediate forex traders in Nigeria. It comes with an average spread of 1.4 pips and there are no commissions. It also comes with high leverage of up to 1:500. The minimum deposit for this account is $5000 and the base currency is USD. It is worth noting that the Standard Account is only available on MT4.

Advanced Account

This is a good account for traders with more experience. It comes with an average spread of 1.1 pips and there are no commissions. It also comes with high leverage of up to 1:500. The minimum deposit for this account is $25,000 and the base currency is USD. As with the other accounts, it is worth noting that the Advanced Account is only available on MT4.

Premium Account

This is a great account for professional traders. It comes with an average spread of 0.0 pips and there is a $4 commission per side. It also comes with high leverage of up to 1:500. The minimum deposit for this account is $50,000 and the base currency is USD. As with the other accounts, it is worth noting that the Advanced Account is only available on MT4.

Islamic swap-free accounts are also available upon request. The range of options allows Nigerian traders to choose an account that best suits their needs and budget. While minimum deposits are higher than some brokers, the tight spreads and high leverage available help provide good overall value.

Trading Tools

TrioMarkets provides clients helpful trading tools to enhance their market analysis and trading performance. These include:

- Advanced charting tools in MetaTrader 4

- Free VPS service for qualifying accounts

- Trading signals from in-house analysts

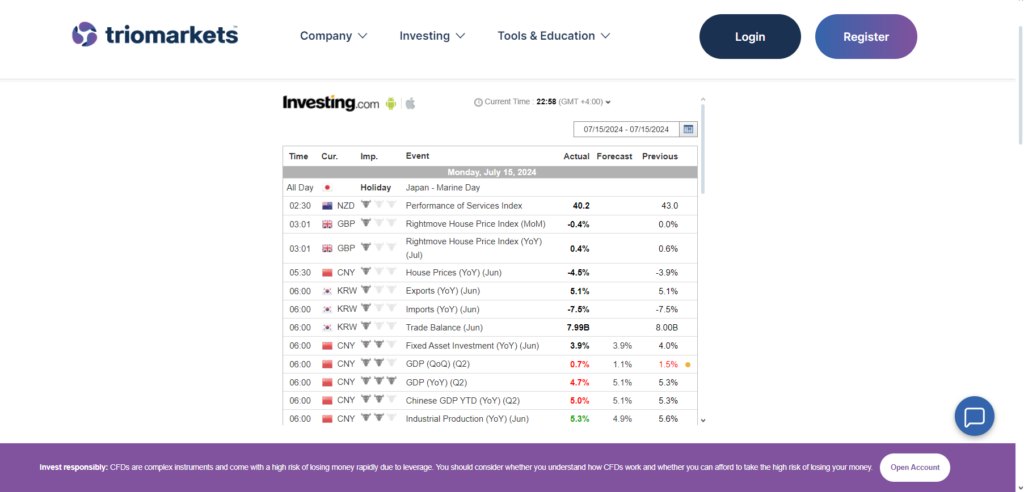

- Economic calendar to track key events

- Regular market analysis and insights

These tools are designed to give Nigerian traders an edge and help inform smarter trading decisions. TrioMarkets clients can access these valuable resources right from their trading accounts.

Leverage, Spreads and Commissions

TrioMarkets allows leverage as high as 1:500, depending on the instrument traded. For forex, the maximum leverage is usually 1:500. This allows traders to open larger positions with less capital but also increases risk. Leverage should be used cautiously.

TrioMarkets offers very competitive spreads, especially on its Premium and VIP accounts. With the broker’s raw pricing, spreads can be as low as 0.0 pips on major forex pairs like EUR/USD. For commission-free accounts, minimum spreads range from 1.1 to 2.4 pips based on account type.

On the VIP account with raw spreads, TrioMarkets charges a reasonable commission of $4 per round turn standard lot or $8 per total. There are no hidden fees, and the broker is transparent about its pricing.

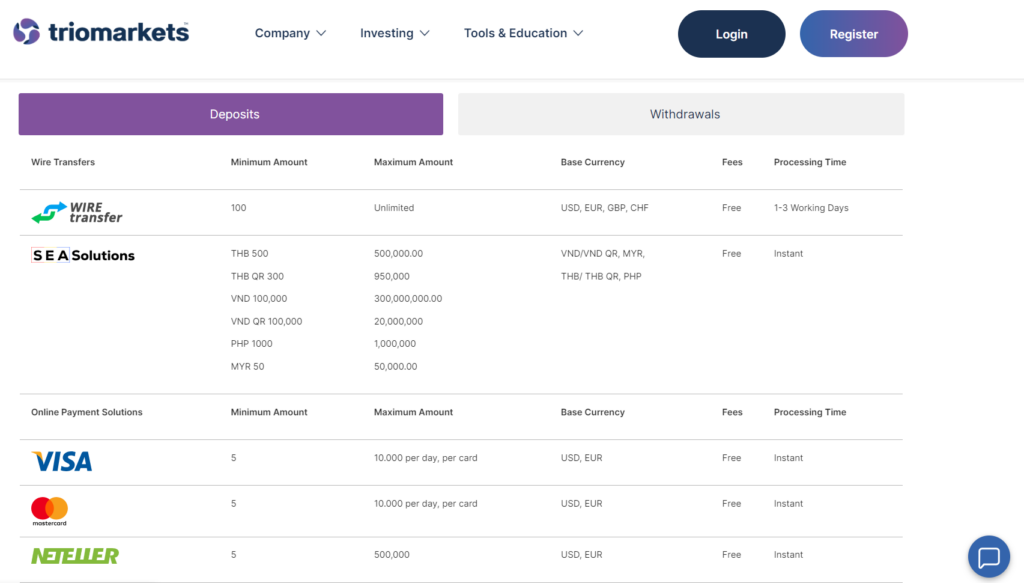

Deposits and Withdrawals

Funding your TrioMarkets account is simple and convenient thanks to the TrioMarkets Wallet. This feature allows you to easily transfer funds between your wallet and trading accounts at any time. TrioMarkets also accepts wire transfers, allowing for secure bank-to-bank or person-to-institution money transfers while keeping your private financial details safe.

Withdrawing funds from TrioMarkets is designed to be just as straightforward as depositing. The broker guarantees a fixed processing time that varies depending on your account type, ranging from 24 hours down to just 6 hours. You must use the same payment method for withdrawals as you did for your initial deposit. If your withdrawal amount exceeds your initial deposit, the difference will be transferred via bank wire.

TrioMarkets charges a 1% withdrawal fee for transactions via Visa, Mastercard, or Neteller. For wire transfers, there is a 1.5% fee with a minimum charge of 25.00 and a maximum of 50.00 in your account’s base currency. Withdrawal requests under 100.00 are subject to a fixed fee of 5.00 in your base currency.

Please note that funds will only be transferred into an account that is registered in the same name as the TrioMarkets account holder. For account closures, transfer conditions can be negotiated with customer support.

Account Registration

Opening a live TrioMarkets account is a fully digital process that can be completed in a few simple steps:

- Visit the TrioMarkets website and click “Register.”

- Fill in the online registration form with your details

- Verify your email address

- Provide the required identity and residency documentation

- Wait for your account to be approved and make your first deposit

Once your TrioMarkets live account is active and funded, you can download MetaTrader 4, log in with your credentials, and start trading. Demo accounts are also available if you wish to practice risk-free first.

Bonuses and Promotions

TrioMarkets offers occasional bonuses and promotional offers to its clients. Specifics vary over time, but some examples include:

- Welcome Bonus

- Loyalty Program

- Refer-a-Friend

It’s important to carefully review the terms and conditions of any bonus offer before accepting it, as there are usually requirements that must be met to realize the full benefit.

Trading Platforms

TrioMarkets provides the popular MetaTrader 4 (MT4) platform for trading on desktop, web, and mobile devices. Key features of MT4 include:

- Intuitive, customizable interface

- Advanced charting tools with extensive indicators and drawing tools

- Ultra-fast order execution with one-click trading

- Automated trading compatible with expert advisors (EAs)

- Secure, encrypted communication between trader and broker

The MT4 platform is an industry-standard packed with tools to help you analyze markets, place trades, and manage your account. You can even trade on the go with MT4’s full-featured mobile apps for iOS and Android. TrioMarkets also offers support for additional tools that expand the default MT4 capabilities.

Education and Research

To help clients make informed trading decisions, TrioMarkets offers a variety of educational and research resources, including:

- In-depth forex educational courses for beginners and more experienced traders

- Regular webinars on market analysis, trading strategies, and platform tutorials

- Detailed eBooks on trading psychology, technical and fundamental analysis, and more

- Economic calendar

The broker’s education section is designed to help you expand your knowledge and hone your skills, whether you’re just starting or are an experienced trader looking to refine your edge.

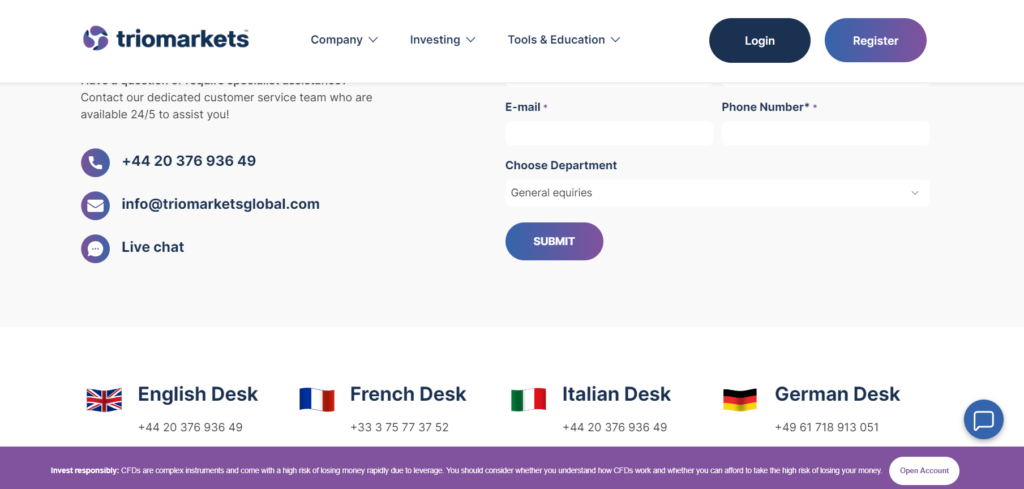

Customer Support

TrioMarkets provides 24/5 customer support via live chat, phone, and email. The customer service team is helpful and ready to assist with all types of account, trading, or platform-related queries.

The broker’s website also contains information to help you get the most out of your trading experience, including detailed FAQs, trading guides, and platform tutorials. Overall, TrioMarkets values customer support and provides responsive, personable service.

Our Verdict on TrioMarkets for Nigerian Traders

After thoroughly reviewing TrioMarkets, we believe this broker is a solid choice for Nigerian traders. TrioMarkets offers strong regulation, competitive trading conditions, a wide range of instruments, and the popular MT4 platform. The broker provides quality educational resources and reliable customer support. While minimum deposits are higher than some brokers, TrioMarkets’ overall package of features and benefits makes it a compelling choice. For Nigerian traders seeking a reputable, long-established broker, TrioMarkets is well worth considering.

TrioMarkets Forex Broker Review – FAQ

TrioMarkets is not directly regulated by Nigerian authorities. However, the broker is licensed in major jurisdictions like Cyprus (CySEC) and Mauritius (FSC), providing strict regulatory oversight that extends to its global client base, including Nigerians.

TrioMarkets keeps client funds in segregated accounts at top-tier banks, ensuring your deposits are not mixed with the broker’s capital. The broker has a long track record of financial stability and regulatory compliance, making it a secure choice to trust with your money. The broker also offers negative balance protection for added peace of mind.

TrioMarkets accounts are denominated in USD, EUR, GBP and CHF. Nigerian traders must convert their Naira into one of these base currencies to fund their accounts. The broker recommends using a low-fee currency conversion service for the best exchange rates.

Ready to start trading? Sign up for an online trading account with TrioMarkets here.

TrioMarkets Forex Broker Review – Similar Brokers

TrioMarkets is a great choice for forex traders. However, if you want to see some alternatives, there are also many other brokers in Nigeria. Here are some brokers like TrioMarkets.

Broker | |||||

Review | |||||

CopyTrading | |||||

Platforms |

Still deciding? Take a look at some of our other forex broker reviews.