Are you a Nigerian trader searching for the best MT4 forex brokers? This comprehensive guide will analyze the world of MetaTrader 4 (MT4) and explore the top brokers offering this powerful platform, tailored specifically for Nigerian traders. Whether you’re a beginner or an experienced trader, understanding the benefits of MT4 and choosing the right broker can make a significant difference in your trading journey.

Here is our list of top brokers offering trading on the MT4 platform.

Broker | Features | Broker Review | Visit |

* 1:1000 leverage * 1200+ instruments * $50 min. deposit * Tight spreads | |||

* 1:1000 leverage * 210+ instruments * $100 min. deposit * Free education | |||

* 1:888 leverage * 1000+ instruments * $5 min. deposit * Free education | |||

* 1:500 leverage * 80+ instruments * $200 min. deposit * Excellent support | |||

* 1:500 leverage * $100 min. deposit | |||

* 1:1500 leverage * $100 min. deposit * Free analysis | |||

* 1:400 leverage * $100 min. deposit | |||

* 1:500 leverage | |||

* 1:500 leverage * 100+ instruments * Free education | |||

* 1:1000 leverage * 950+ instruments * Copy trading | |||

* Low deposit | |||

* 1:1000 leverage | |||

* 1:500 leverage * 10,000+ instruments * $100 min. deposit * Ultra low latency | |||

* 1:500 leverage * 800+ instruments * $10 min. deposit * African broker | |||

*1:500 leverage | |||

* 1:500 leverage * 390 instruments * $10 min. deposit * Great support | |||

* 1:400 leverage | |||

*Cryptotrading * $100 min. deposit | |||

* 1:500 leverage * $1 min. deposit | |||

* 1:500 leverage * 300+ instruments * $50 min. deposit * Great education | |||

* 1:1000 leverage * 950+ instruments * $250 min. deposit * Copy trading | |||

* 1:500 leverage * 1000+ instruments * $200 min. deposit * Crypto CFD trading | |||

* 1:2000 leverage * 140+ instruments * Great bonuses | |||

* 1:1000 leverage * 130+ instruments * $5 min. deposit * Raw spreads | |||

* 1:3000 leverage * 230+ instruments * $100 min. deposit * Great bonuses | |||

* 1:500 leverage | |||

* 1:30 leverage | |||

* 1:200 leverage | |||

* 1:400 leverage | |||

* 1:1000 leverage | |||

* 1:500 leverage | |||

* 1:777 leverage |

Contents

- 1 What is an MT4 Broker?

- 2 Why Choose an MT4 Broker in Nigeria?

- 3 1. Familiarity with the Platform

- 4 2. Advanced Trading Tools

- 5 3. Automated Trading

- 6 4. Mobile Trading

- 7 5. Wide Range of Instruments

- 8 Step 1: Choose a Reliable MT4 Broker

- 9 Top 3 MT4 Brokers for Nigerian Traders

- 10 HFM

- 11 FXPesa

- 12 FXPro

- 13 Step 2: Download and Install MT4

- 14 Step 3: Open an Account and Log In

- 15 Step 4: Familiarize Yourself with the MT4 Interface

- 16 Step 5: Set Up Your Charts

- 17 Step 6: Place and Manage Trades

- 18 Step 7: Utilize Advanced MT4 Features

- 19 Step 8: Continuously Educate Yourself

- 20 MT4 Trading Tips for Nigerian Traders

- 21 Develop a Trading Plan

- 22 Practice with a Demo Account

- 23 Manage Your Risk

- 24 Keep a Trading Journal

- 25 Stay Informed

- 26 Start Your MT4 Trading Journey in Nigeria Today

- 27 MT4 Brokers for Nigerian Traders: FAQs

What is an MT4 Broker?

Developed in 2005 by the Russian MetaQuotes Software Corporation, MetaTrader 4, or MT4, is one of the most popular trading platforms. Since its release, the platform has taken the world of trading by storm and completely shifted how retail clients engage with the forex market. Traders can easily access a variety of forex pairs, indices, commodities, and cryptocurrencies using advanced charting and an intuitive interface. MT4 has grown immensely in popularity due to its plethora of customizable indicators and builders and the ability to integrate Expert Advisors.

One of MT4’s key advantages is its flexibility. Traders can personalize their trading experience and build their trading systems with the programming language embedded in the window, MQL4. This means they can use automation to execute some of their trades, backtest their trading strategy, and tweak everything they need for optimal performance. Another benefit is the extensive collection of pre-built indicators and EAs available in MT4. This makes traders more equipped to scan the market for opportunities and make well-informed trading decisions.

Why Choose an MT4 Broker in Nigeria?

Nigerian traders can significantly benefit from using an MT4 broker for several compelling reasons:

1. Familiarity with the Platform

Most Nigerian traders are already familiar with using MT4, which means switching to a new broker will be much easier while retaining the same platform. That way, traders can focus on optimizing their trading strategies rather than learning an entirely new platform.

2. Advanced Trading Tools

Another benefit of MT4 is that it offers Nigerian traders many technical indicators and charting tools. These tools come in different chart types, timeframes, and drawing tools, which a trader in Nigeria can use to analyze trend lines and isolate potential entry and exit points. Indicators are tools within the MT4 platform that help a trader make a logical and informed decision.

3. Automated Trading

Using expert advisors, Nigerian traders can automate their trading strategies, which means saving time and effort and, at the same time, maximizing profits accurately. EAs are specialized trading robots that operate under specific algorithmic scenarios, which they are programmed to do. When they know when to buy and when to sell, their input is priceless, especially if the trader has no time to track the market 24 hours a day.

4. Mobile Trading

MT4 offers a mobile trading app for iOS and Android devices, allowing Nigerian traders to access their accounts and trade on the go. This flexibility is crucial in today’s fast-paced world, where market opportunities can arise anytime.

5. Wide Range of Instruments

MT4 brokers typically offer diverse trading instruments, including forex pairs, indices, commodities, and cryptocurrencies. This variety allows Nigerian traders to diversify their portfolios and exploit different market conditions.

Step 1: Choose a Reliable MT4 Broker

Before diving into the MT4 platform, selecting a reputable broker that offers MT4 and meets your trading requirements is crucial. When deciding, consider factors such as regulation, trading conditions, minimum deposit, and customer support.

Top 3 MT4 Brokers for Nigerian Traders

HFM

- Regulated by CySEC and FSA

- 1:1000 leverage

- Tight spreads

- $50 minimum deposit

- 24/5 customer support

FXPesa

- 1:400 leverage

- 200+ instruments

- $5 minimum deposit

- Fast account opening

- Regulated by CBK and CMA

FXPro

- Regulated by CySEC, FCA, and FSCA

- 1:1500 leverage

- Competitive spreads

- $100 minimum deposit

- Negative balance protection

Step 2: Download and Install MT4

Once you’ve chosen your broker, head to their website and download the MT4 platform. The installation process is straightforward and typically involves the following steps:

- Run the downloaded file and select your preferred language.

- Choose the installation directory and click “Next.”

- Select the components you wish to install and click “Next.”

- Confirm the installation and wait for the process to complete.

Step 3: Open an Account and Log In

After installing MT4, open the platform and log in using your broker-provided credentials. If you don’t have an account yet, follow these steps:

- Click on the “File” menu and select “Open an Account.”

- Fill in the required personal information and apply.

- Once your account is approved, log in to MT4 using your credentials.

Step 4: Familiarize Yourself with the MT4 Interface

Take some time to explore the MT4 interface and familiarize yourself with its key features:

- Main Menu: Access various platform options, including opening new charts, placing trades, and managing your account.

- Toolbars: Quick access to essential tools like zooming, drawing, and timeframe selection.

- Market Watch: View live prices for various instruments and add them to your charts.

- Navigator: Manage your accounts, indicators, and Expert Advisors (EAs).

- Terminal: Monitor your trade activity, account history, and news events.

Step 5: Set Up Your Charts

To begin analyzing the markets, set up your charts:

- Right-click on the instrument you want to analyze in the Market Watch window and select “Chart Window.”

- Customize your chart by selecting your desired timeframe, type, and colors.

- Add technical indicators by dragging them from the Navigator window onto your chart.

- Use drawing tools to identify support and resistance, trendlines, and other key price levels.

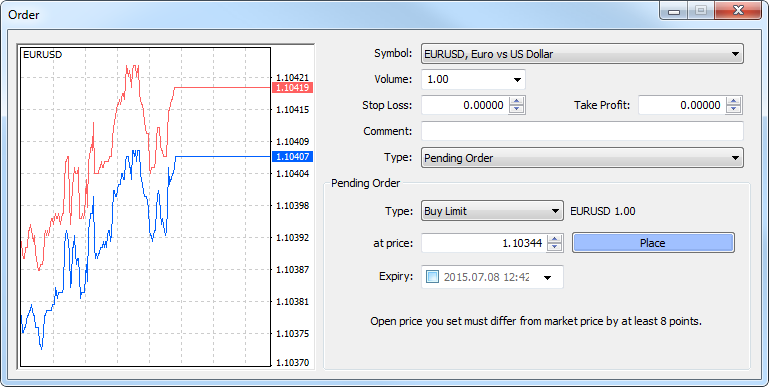

Step 6: Place and Manage Trades

Once you’ve analyzed the markets and identified potential trading opportunities, it’s time to place your trades:

- Right-click on the chart or instrument in the Market Watch window and select “New Order.”

- Choose your trade type (e.g., Buy or Sell), lot size, stop loss, and take profit levels.

- Confirm your order and monitor your trade in the Terminal window.

- Manage your open trades by modifying stop loss and taking profit levels or closing positions when necessary.

Step 7: Utilize Advanced MT4 Features

To take your trading to the next level, explore MT4’s advanced features:

- Expert Advisors (EAs): Automate your trading strategies using algorithmic trading programs.

- Custom Indicators: Create or import custom technical indicators to enhance market analysis.

- Backtesting: Test your trading strategies on historical data to assess and optimize their performance.

- Alerts: Set up price or indicator-based alerts to stay informed about market movements.

Step 8: Continuously Educate Yourself

To succeed as a trader, it’s essential to continuously educate yourself about the markets, trading strategies, and risk management. Take advantage of the educational resources provided by your broker, such as webinars, tutorials, and market analysis. Join trading communities and forums to learn from experienced traders and stay up-to-date with the latest market trends.

MT4 Trading Tips for Nigerian Traders

Develop a Trading Plan

Create a well-defined trading plan that outlines your goals, risk tolerance, and strategies. Stick to your plan and avoid impulsive decisions.

Practice with a Demo Account

Before trading with real money, practice your strategies on a demo account to familiarize yourself with the platform and test your skills in a risk-free environment.

Manage Your Risk

Implement proper risk management techniques, such as setting stop losses and limiting exposure to any trade. Never risk more than you can afford to lose.

Keep a Trading Journal

Maintain a trading journal to track your trades, analyze your performance, and identify areas for improvement. Review your journal regularly to learn from your successes and mistakes.

Stay Informed

Keep abreast of the latest market news, economic events, and geopolitical developments that may impact your trades. Use reliable sources and consider their potential influence on your trading decisions.

Start Your MT4 Trading Journey in Nigeria Today

Now that you understand the best MT4 forex brokers available in Nigeria, it’s time to embark on your trading journey. When selecting your broker, remember to prioritize regulation, trading conditions, and customer support. By choosing a reputable MT4 broker that aligns with your needs and preferences, you can confidently navigate the exciting world of forex trading and work towards achieving your financial goals.

As you begin your trading journey, it’s crucial to continue educating yourself about the markets, risk management, and trading psychology. Take advantage of your chosen broker’s educational resources and tools, and consider joining trading communities or seeking guidance from experienced traders. Remember, successful trading requires discipline, patience, and a willingness to learn from your successes and failures.

With the right MT4 broker by your side and a commitment to continuous learning and growth, you can unlock the potential of the forex market and pave the way for a successful trading career in Nigeria. So, choose wisely, trade responsibly, and most importantly, enjoy the thrilling forex trading ride!

MT4 Brokers for Nigerian Traders: FAQs

1. Is forex trading legal in Nigeria?

Forex trading is legal in Nigeria, provided you trade with a broker regulated by the Central Bank of Nigeria or other reputable international regulatory bodies. However, it’s essential to be aware of the risks involved and to only trade with funds you can afford to lose.

2. Can I use MT4 on my mobile device?

Absolutely! Most MT4 brokers offer mobile trading apps for iOS and Android devices, allowing you to trade on the go. These apps provide a streamlined version of the desktop platform, enabling you to monitor your trades, analyze charts, and execute orders from your smartphone or tablet.

3. Do MT4 brokers offer Islamic (swap-free) accounts?

Many MT4 brokers provide swap-free accounts for Muslim traders who wish to comply with Sharia law. These accounts do not incur overnight interest charges, making them suitable for Islamic traders. However, some brokers may charge a fixed commission or have other restrictions on swap-free accounts, so be sure to check with your chosen broker for their specific terms and conditions.

Check out our forex broker reviews to learn more about the best forex brokers in Nigeria. Also, read our blog to discover the latest forex broker news and promotions.