| 🔒 Regulations | MISA (Comoros), CySEC (Cyprus), FSCA (South Africa) |

| 🌐 Supported | English, Urdu, Hindi, Indonesian, Portuguese, Thai, |

| Languages | Spanish, Chinese, Vietnamese, Malaysian, German |

| 💰 Products | Currencies, Stocks, Crypto, Indices, Commodities |

| 💵 Min Deposit | $25 |

| 📈 Max Leverage | 1:1000 (MISA), 1:30 (CySEC), 1:500 (FSCA) |

| 💻 Trading Desk | ECN, STP |

Contents

- 1 Our Opinion About Octa

- 2 Regulation in Nigeria

- 3 Octa Forex Broker Review: Legit or Scam?

- 4 Octa Trading Instruments

- 5 Octa Account Types

- 6 OctaTrader Account

- 7 Octa MT5 Account

- 8 Octa MT4 Account

- 9 Trading Tools

- 10 Octa Leverage, Spread, and Commissions

- 11 Octa Deposits and Withdrawals

- 12 Deposit Methods

- 13 Withdrawal Methods

- 14 Local Bank Transfers

- 15 Currency Conversion

- 16 Security and Protection

- 17 Octa Forex Broker Registration — How to Open a Trading Account

- 18 Octa Bonuses and Promotions

- 19 50% Deposit Bonus

- 20 Demo Trading Contests

- 21 Octa Trading Platforms

- 22 Octa Education and Research

- 23 Octa Forex Broker Customer Support

- 24 Our Verdict

- 25 Octa Forex Broker Review FAQs

Our Opinion About Octa

Octa has been a renowned international forex and CFD broker catering to traders’ needs since 2011. The broker has earned a solid reputation in the industry with its tight spreads, diverse selection of tradable instruments, and compatibility with the widely used MetaTrader 4 and 5 platforms.

Octa presents an attractive option for Nigerian traders searching for a budget-friendly, feature-packed broker. Please read through our comprehensive Octa Forex broker review to better understand what this broker offers and determine whether it aligns with your trading requirements and preferences.

Regulation in Nigeria

Octa has demonstrated its legitimacy and commitment to clients through its licenses from reputable authorities such as the Cyprus Securities and Exchange Commission (CySEC) and South Africa’s Financial Sector Conduct Authority (FSCA). The broker’s longevity in the industry and numerous accolades further solidify its credibility.

Octa Forex Broker Review: Legit or Scam?

Our extensive research and brokerage industry knowledge have shown that Octa is a legitimate broker. With over a decade of operation, Octa Forex Broker has demonstrated a commitment to its clients. The broker also uses practices like segregating client funds and providing negative balance protection to ensure the safety of traders’ investments further.

Octa Trading Instruments

Octa offers over 230 trading instruments across key asset classes, providing Nigerian traders with a diverse range of options:

- 35 currency pairs

- 50 CFDs on stocks

- Five commodity CFDs (including gold and silver)

- 10 index CFDs

- 30 cryptocurrency CFDs

This comprehensive selection of instruments covers major markets and should satisfy the needs of most retail traders in Nigeria.

Octa Account Types

This forex broker provides three main account types, each associated with a different trading platform:

| Account Type | Minimum Deposit | Spreads (from) | Commissions | Leverage | Instruments | Platform | Islamic Account |

| OctaTrader | $25 | 0.6 pips | No | Up to 1:500 | 80 | Web-based | Yes (Swap-free) |

| Octa MT5 | $25 | 0.6 pips | No | Up to 1:500 | 277 | MetaTrader 5 | Yes (Swap-free) |

| Octa MT4 | $25 | 0.6 pips | No | Up to 1:500 | 80 | MetaTrader 4 | Yes (Swap-free) |

OctaTrader Account

The OctaTrader account is ideal for traders who prefer a web-based platform. With a minimum deposit of just $25, this account offers competitive spreads starting from 0.6 pips and no trading commissions. Leverage up to 1:500 is available, and traders can access 80 instruments, including forex, metals, energies, indices, and cryptocurrencies.

Octa MT5 Account

For traders who prefer the advanced features of MetaTrader 5, the Octa MT5 account is an excellent choice. Like the OctaTrader account, it requires a minimum deposit of $25 and offers spreads from 0.6 pips with no commissions. Leverage up to 1:500 is available, and traders can access an impressive 277 instruments, including forex, metals, energies, indices, cryptocurrencies, stocks, and intraday assets.

Octa MT4 Account

The Octa MT4 account caters to traders who prefer the simplicity and reliability of the MetaTrader 4 platform. This account offers attractive trading conditions with a minimum deposit of $25, spreads from 0.6 pips, and zero commissions. Leverage up to 1:500 is available, and traders can access 80 instruments, including forex, metals, energies, indices, and cryptocurrencies.

All Octa accounts are swap-free, making them suitable for Islamic traders who adhere to Sharia principles. This means that overnight interest, or swap fees, are not charged on any open positions held overnight. Also, Octa Forex Broker provides free practice demo accounts. Demo accounts allow traders to test strategies and familiarize themselves with trading platforms using virtual funds without risking real money. This feature is particularly beneficial for new traders in Nigeria who want to gain experience before investing their capital.

Trading Tools

Octa equips traders with useful tools to enhance their trading experience:

- Economic calendar

- Trading ideas and strategies

- Forex news

- Autochartist for automated analysis and trade signals

- Account monitoring tool to track fellow Octa traders

These tools can help Nigerian traders make informed decisions and stay up-to-date with market developments.

Octa Leverage, Spread, and Commissions

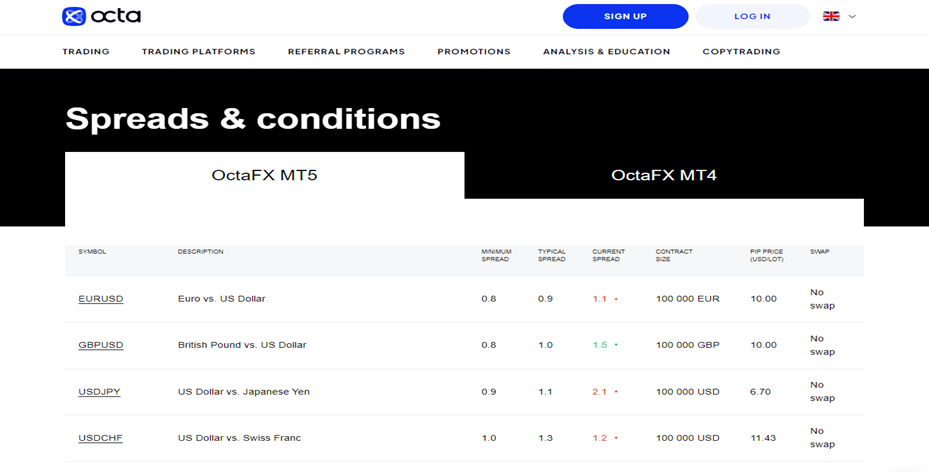

Octa allows leverage up to 1:500 on forex pairs, with lower ratios for other assets. Spreads are competitive, starting at 0.6 pips on the EUR/USD with an average of around 0.9 pips. The broker does not charge trading commissions, making it an attractive choice for cost-conscious Nigerian traders.

Octa Deposits and Withdrawals

Octa offers seamless transfers with no commissions or hidden charges. The broker supports a wide range of popular payment methods for deposits and withdrawals, ensuring convenience for traders in Nigeria.

Deposit Methods

Octa accepts the following deposit methods with no fees and varying minimum amounts:

| Method | Minimum Amount | Processing Time |

| Visa/Mastercard | 25 USD / 50 EUR | Instant |

| Skrill/Neteller | 50 USD | Instant |

| Bitcoin | 0.00037000 BTC | 3-30 minutes |

| Ethereum | 0.02000000 ETH | 3-30 minutes |

| Litecoin | 0.30000000 LTC | 3-30 minutes |

| Dogecoin | 230.00000000 DOGE | 3-30 minutes |

| Tether (ERC-20) | 50.00000000 USDTE | 3-30 minutes |

| Tether (TRC-20) | 50.00000000 USDTT | 3-30 minutes |

To make a deposit, log in to your Octa profile, select the “New Deposit” option, choose your preferred trading account and payment method, and follow the instructions.

Withdrawal Methods

Withdrawals can be made using the same methods available for deposits, and Octa charges no fees. To withdraw funds, ensure your account is verified as required by law, log in to your profile, select “Withdrawals,” choose the payout method and trading account, and provide the necessary information. Octa processes withdrawals swiftly, typically within 3 hours, ensuring Nigerian traders can access their funds promptly.

Local Bank Transfers

For Nigerian traders who prefer using local banks, Octa provides a convenient process:

1. Choose your preferred transfer method (ATM, bank branch, mobile, or online banking).

2. Specify the payment details provided in your Octa Personal Area.

3. Keep the receipt or payment proof and notify Octa about the transfer.

Currency Conversion

Octa offers competitive rates for currency conversions, allowing Nigerian traders to deposit and withdraw funds in their preferred currency. The broker’s calculator helps estimate the amount in your trading account after conversion.

Security and Protection

Octa prioritizes the security of client funds, employing stringent measures to safeguard deposits and withdrawals. The broker also offers negative balance protection, ensuring traders cannot lose more than their account balance, preventing them from falling into debt.

This ensures Octa’s Nigerian clients a seamless and reliable deposit and withdrawal experience. The broker’s commitment to transparency and zero fees further enhances the trading conditions for its users.

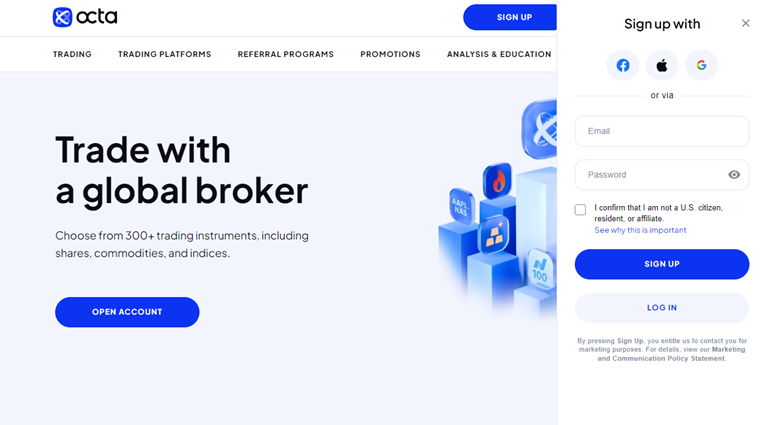

Octa Forex Broker Registration — How to Open a Trading Account

Opening an account with this forex broker is quick and fully digital. Sign up on their website, providing your email and basic personal details. Select your preferred account type and verify your identity by submitting proof documents before withdrawing. The entire registration process is straightforward, making it easy for Nigerian traders to start.

Octa Bonuses and Promotions

50% Deposit Bonus

Octa clients can claim a 50% bonus on deposits over \$50. The bonus isn’t automatic – you must activate it after making an eligible deposit. You must trade half the bonus amount in standard lots to withdraw the bonus funds. For example, to cash out a \$100 bonus, 50 lots need to be traded.

Demo Trading Contests

Octa forex broker regularly hosts demo trading competitions where participants can win real money without risking their capital. These contests offer an excellent opportunity for Nigerian traders to hone their skills and gain additional funds.

Octa Trading Platforms

Octa forex broker supports the industry-standard MetaTrader 4 and MetaTrader 5 platforms for desktop, web, and mobile trading. Their proprietary OctaTrader web platform and copy trading app provide additional options tailored to specific trading needs.

| Platform | Availability |

| OctaTrader | Web, Android, iOS |

| MetaTrader 4 | Desktop, Web, Android, iOS |

| MetaTrader 5 | Desktop, Web, Android, iOS |

| Octa Copy Trading App | Web, Android |

These platforms offer Nigerian traders a range of options to suit their preferences and trading styles.

Octa Education and Research

Octa’s educational offerings cover the basics well, though more advanced materials would be beneficial. Resources include:

- Beginner-friendly articles and video courses

- Platform tutorials in article and video format

- Live and recorded webinars

- Forex news and market analysis

While not as comprehensive as the best forex brokers, the research section provides useful content like an economic calendar, trading ideas, and strategies. These resources can help Nigerian traders improve their knowledge and make informed trading decisions.

Octa Forex Broker Customer Support

Octa offers 24/7 customer support through multiple channels:

- Live chat

- Telephone

- Telegram

The live chat is responsive but may not always provide in-depth answers. Email support offers more detailed assistance. Local phone numbers are available for several countries, ensuring Nigerian traders can access support when needed.

Our Verdict

Octa stands out as an attractive low-cost broker for Nigerian traders. With tight spreads, zero commissions, and a good range of trading instruments, the broker caters well to the needs of most retail clients. The innovative copy trading platform and swap-free accounts add to its appeal. Octa is a solid choice for Nigerian traders who are comfortable with an offshore-regulated broker, offering favorable trading conditions and a range of useful features. As with any forex broker, it is essential to carefully consider individual trading needs and risk tolerance before deciding.

Octa Forex Broker Review FAQs

Octa offers traders the flexibility to choose between the industry-standard MetaTrader 4 and 5 platforms and their own intuitive web-based platform. All platforms have advanced charting capabilities and analytical tools to suit different trading styles and preferences.

Octa forex broker is a reliable and secure broker, licensed and regulated by respected financial authorities. The broker employs cutting-edge encryption technology to protect client’s personal information and maintains segregated client funds to ensure the safety of their capital.

Octa offers tight spreads and a transparent fee structure, allowing traders to know precisely what they pay for each trade. The broker also has low minimum deposit requirements, making it an attractive choice for novice traders.

Octa withdrawals typically take anywhere from a few hours to 7 business days to process. However, the processing time may vary depending on factors such as the withdrawal method and potential delays from the client’s bank.