When you’re just starting out, all the new terminology can be a bit confusing. But don’t worry, we’re here to help. Today we’ll be looking at the terms people use to describe different trading positions.

What is a Long Position?

As you know, forex trading involves buying one currency and selling another. A long position is taken when a trader buys a currency expecting it to appreciate in value against the other currency it is paired with. This can also be referred to as “going long” on a trade. It is simply buying the base currency and selling the quote currency. Let’s look at an example.

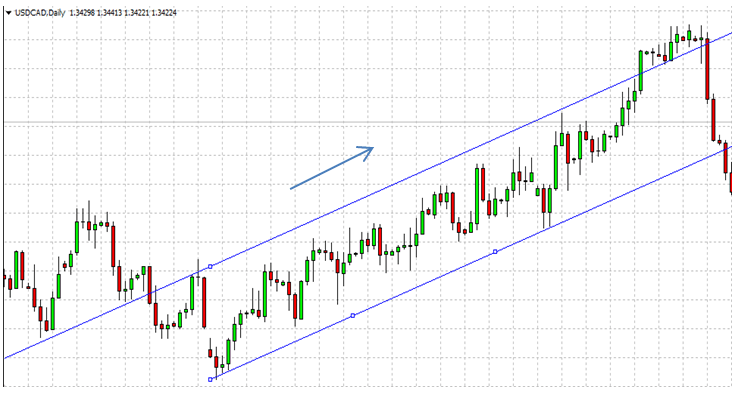

This USD/CAD chart shows a series of higher highs and higher lows. It looks like an upward trend, and it looks like the USD is probably going to keep appreciating in value. In this scenario, you would buy USD and sell CAD, and you would ‘go long’.

What is a Short Position?

Traders enter a short position by selling the base currency and buying the quote currency expecting that the base currency will depreciate in value against the quote currency. This is “going short” on a currency pair.

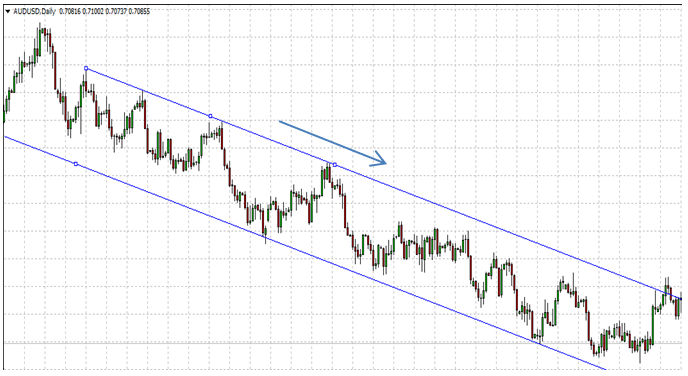

For example, the daily AUD/USD chart above indicates a series of lower highs and lower lows, thus a downtrend. A trader would go short on this pair expecting that the AUD will continue to depreciate in value against the USD. The trader will be said to be in a short position.

Final Thoughts

Long and short positions are favourable in rising and falling markets respectively. Apart from long and short positions, there are other important terminologies that every trader should be familiar with, and improving your knowledge will further increase your chances of success.

Ready to learn more about forex trading? Check out our education section for more articles.