A pip is a unit of measurement that indicates the smallest change in value between two currencies. The term “pip” stands for Price Interest Point or Percentage in Point.

Pips are quoted to either four or two decimal places. For most currency pairs, pip movements are quoted to the fourth decimal place. The one exception to this is the Japanese Yen (JPY), which is quoted to the second decimal place.

For example, if GBP/USD moves from 1.4250 to 1.4251, then we say that the price has moved by one pip (0.0001). In this situation, the movement is in the fourth decimal place. Also, if the price moves from 1.4251 to 1.4295, then it has risen by 44 pips.

For EUR/JPY, when the price moves from 130.40 to 130.41, then the price has increased by one pip (0.01) in the second decimal place. Secondly, if the price moves from 130.41 to 130.10, then it has dropped by 31 pips.

In the Forex market, knowing the value of a pip helps you manage risk. This is because it enables you to decide how much risk you are willing to take when investing. Moreover, you can know how much you stand to gain or lose for each of your trades.

Understanding Fractional Pips

Commonly known as a “point”, or as “a pipette”, a fractional pip is one tenth of a pip. This means that, for most currencies, the price movements are quoted to five decimal places. Again, The one exception to this is the Japanese Yen (JPY), where the price movements are quoted to the third decimal place.

Let’s look some examples. Suppose, for EUR/USD, that the price being quoted as 1.2000, and then it moves to 1.20005. The 0.00005 movement means the price has increased by 5 points. And suppose, for GBP/JPY, that the price moves from 151.455 to 151.454. As it is the Japanese Yen, it means the price has dropped by one point.

How to Calculate the Value of a Pip

The value of a pip is influenced by many things including: the currency pair being traded, the position size, and the currency exchange rate. The formula for calculating the pip value is:

Value of pip= (1 Pip / Exchange rate) * Position size

Let’s look at an example. Suppose you buy a standard lot of EUR/USD at 1.1640. You close the position at 1.1670 with a profit of 30 pips. To find out the profit made, you need to calculate the value of the pip. Here is how you do it:

Value of pip= (0.0001 / 1.1640) * 100000 = EUR 8.591 or (USD 10 when converted using 1.1640).

Each pip is worth USD 10. Therefore, the profit will be (30 pips * 10) = USD 300

How To Use Pip Calculators

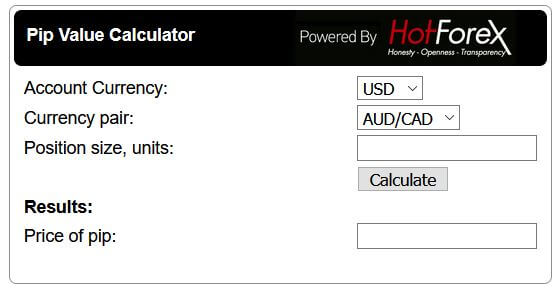

You can use a calculator to help you calculate the value of a pip. It is important to note that the value of a pip differs between different currency pairs. Luckily, many Forex brokers provide these kinds of calculators free of charge. All you need to do is in fill in some details and the pip value is automatically calculated for you!

From the calculator above, you can see which information you need to fill in.

- Account Currency: This is the currency you’re trading with.

- Currency pair: This is the financial instrument you want to trade.

- Position size: This is the position size you want to trade.

- Price of pip: This is where the value will be indicated after the calculation.

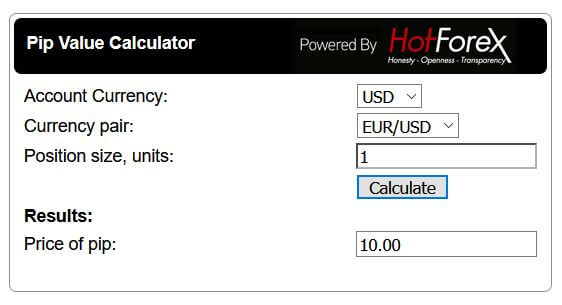

In this example, we will select the USD as the account currency. The currency pair will be EUR/USD and the position size will be 1.

From the results of the pip calculator above, the value of a pip for EUR/USD is 10.

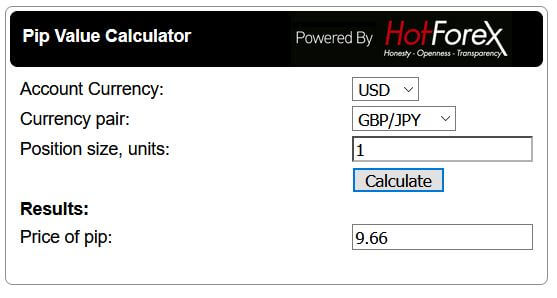

The value of a pip, in this case, is 9.66. This shows that the value varies for different currency pairs.

Final Thoughts

It is important to understand what pips are and how to calculate their value. Once you know this, it makes it manage risk and decide how much capital you want to invest.

Ready to learn more about forex trading? Check out more of our educational articles.